tesla tax credit 2021 washington state

In order to meet the requirements for the credit the business must create new employment positions that increase total employment by 15 or more by March 31 2021. For model year 2021 the credit for some vehicles are as follows.

Biden Plan Would Broaden Ev Tax Credit Include Cash For Clunkers Reboot

Select utilities may offer a solar incentive filed on behalf of the customer.

. 2000 BO tax credit for each qualified position created. Systems installed before December 31 2019 were eligible for a 30 tax credit The tax credit expires starting in 2024 unless Congress renews it. Up to 15000 of the sales or lease price.

Tesla and GM have met. In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020-2022 and 22 for systems installed in 2023. 4502 Chrysler Pacifica Nissan Leaf others.

Tesla and GM are set to regain access to tax credit worth 7000 on 400000 more electric cars in the US with new proposed reform of the federal EV incentive program. Tesla and General Motors are the only manufacturers that have reached the 200000-car milestone meaning new purchases of qualifying vehicles from these manufacturers are not eligible for the electronic car tax credit. Form 8936 Qualified Plug-in Electric Drive Motor Vehicle Credit get one or more credits of up to 7500 on the purchase of a new plug-in electric vehicle.

I think Washington took umbrage with the way Tesla was defining vehicle base prices last time around. In December 2020 the US. Customers who purchase qualified residential fueling equipment before December 31 2021 may receive a tax credit of up to 1000.

With this tax credit youd be getting a rebate on the sales tax you pay up to 2500 on new electric vehicles that cost less than. After this point the credit for that particular vehicle will be reduced and phased out over time. 1 2023 - July 31 2025.

Tax Exemption Washington State. 7500 Note that this credit which became available in 2009 will begin to phase out once auto manufacturers meet their sales quota. It also includes an emergency clause and will go into effect immediately ifwhen signed by the governor.

Tax Exemption Washington State EV Infrastructure Tax Exemption. This may reduce the cost of a more fuel-efficient car but it doesnt. The credit ranges from 2500 to 7500.

The federal governments Zero Emission Vehicle Incentive Program means each automakers eligible plug-in vehicles can receive a tax credit of up to 7500 based on vehicle battery size until 200000 eligible vehicles per manufacturer are registered in the US. Net-Metering is another important solar incentive in. Jay Inslee Washington lawmakers propose electric vehicle rebates and other climate initiatives ahead of legislative session Dec.

The solar Investment Tax Credit ITC which was scheduled to step down to 22 in 2021 and then disappear completely in 2022 has been extended thanks to the hard work and perseverance of the solar community and SEIA. In Washington new vehicles are subjected to a sales tax of 68. However the standard tax credit of 7500 applies retroactively to any Tesla car purchased after May 24 2021 and before January 1 2022.

2500 tax credit for purchase of a new vehicle. Tesla reached this mark in July of 2018 so the 50 credit phase out began in January 2019 and ran through the end of June 2019. As of July 1 only cars costing less than 35000 qualify for the exemption.

This bill will extend the WA state EV sales tax exemption until June 2021 and eliminate the vehicle limit currently 7500 portion of current law. Oregon offer a rebate of 2500 for purchase or lease of new or used Tesla cars. All model 3s were sold as 35000 base price 9000 Long Range Battery accessory 5000 AWD accessory 5000 Performance Package 5000 Premium Package So for the purposes of Base Price every.

Sales or use tax exemption available. Up to 20000 of the sales or lease price. By Stephanie Sheridan Feb 3 2021 Leadership Politics Tax Credit.

You can get a tax credit of 25 for any alternative fuel infrastructure project including building an electric charging station. 1 2019 - July 31 2021. 1 2021 - July 31 2023.

Other Washington Solar Incentives In 2021. WASHINGTON BUSINESS TAX CREDIT Washington businesses are eligible to receive tax credits for purchasing new alternative fuel commercial vehicles. This bill has bi-partisan sponsorship and is supported by the governor.

Up to 25000 of the sales or lease price. Washington State has a sales tax exemption for solar roughly a 10 savings depending on the County where you reside. With this tax credit a rebate sales tax pay 2500 electric vehicles cost Customers purchase qualified residential fueling equipment December 31 2021 receive a tax credit 1000.

Customers who purchase qualified residential fueling equipment before December 31 2021 may receive a tax credit of up to 1000. Congress passed a massive. Looking again at our average Washington residential solar energy system gross cost of 13750 this tax exemption can save you anywhere up to 1375 in taxes.

Sounds very much like full sale price. 1500 tax credit for lease of a new vehicle. Chances are youve heard of the largest government incentive a federal tax credit of up to 7500 for some alternative energy cars.

In Seattle it means a homeowner can save roughly 36 off the full costs of going solar when combined with the Federal Tax Credit. Alternative Fuel Vehicles Plug-In Hybrids Washington State Tax Exemptions. North Carolina offers a state emissions testing exemption and car pool lane access to electric and alternative fuel vehicles.

The state sales tax rate is 65 although with additional local sales tax and use taxes some regions of Washington have a total sales tax rate of over 10. Qualified commercial vehicles must be powered primarily by natural. The State of Washington sales tax exemption no longer applies to Tesla.

Which solar incentives end in 2021. Tax Exemption Washington State.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/H6Y6I2PVNFJ53PLNO3WBO7C3EY.jpg)

Elon Musk Can Afford Biden S Ev Snub Reuters

Latest On Tesla Ev Tax Credit January 2022

Electric Vehicle Buying Guide Kelley Blue Book

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

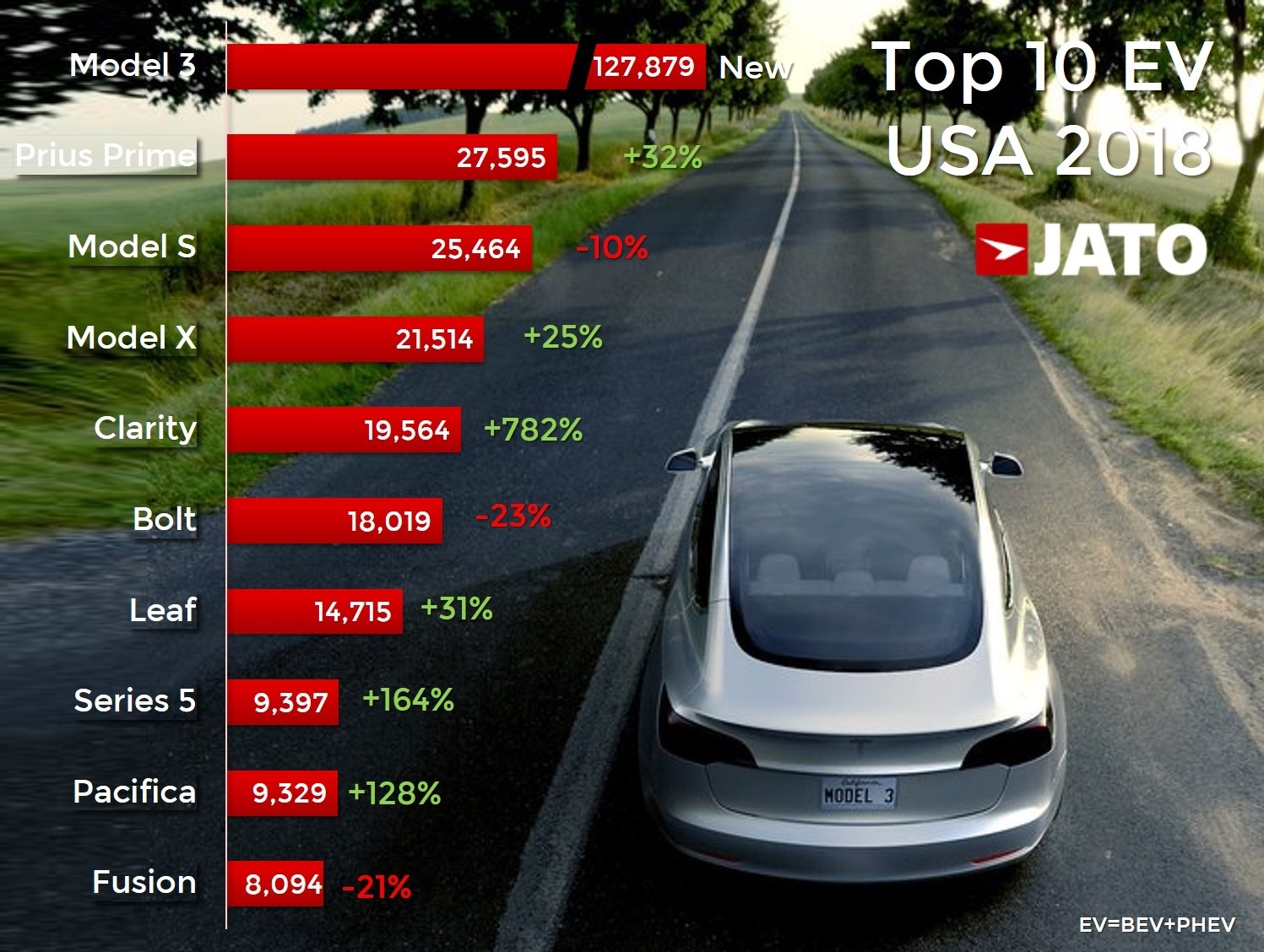

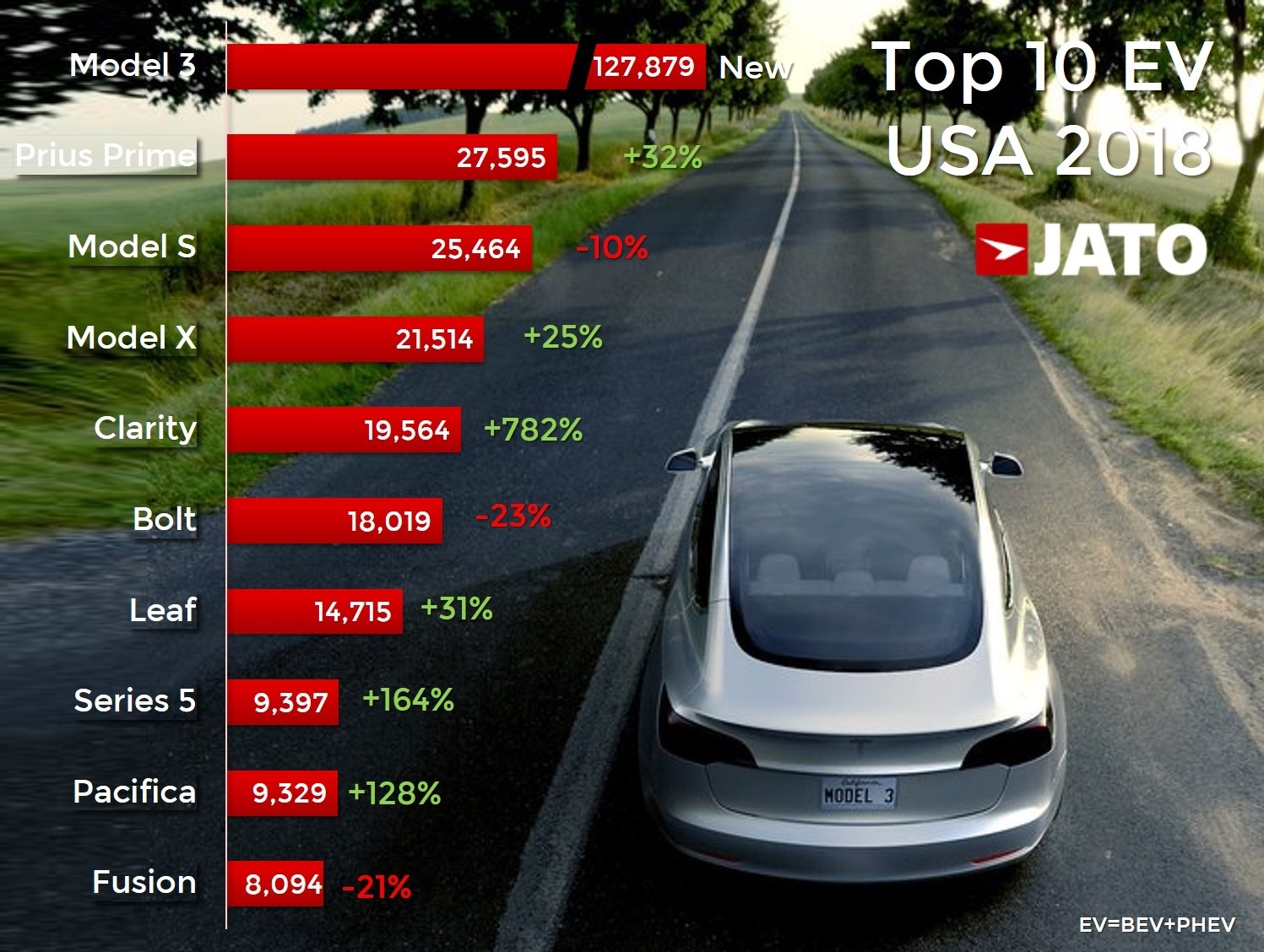

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Ev Tax Credit Calculator Forbes Wheels

Tesla S 7 500 Tax Credit Goes Poof But Buyers May Benefit Wired

Inside Clean Energy Electric Vehicles Are Having A Banner Year Here Are The Numbers Inside Climate News

Behind Washington State S Ev Tax Creating An Electric Vehicle Infrastructure

Inside Clean Energy Electric Vehicles Are Having A Banner Year Here Are The Numbers Inside Climate News

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Roadshow

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek